For example, your company might send a customer an invoice for $10,000 to be paid within 30 days. However, you could offer a sales discount of 1% off if they pay within 10 days (this particular offer would be known as a 1/10 net 30 in discount terms). It also lets a company hold customers accountable for the state of products they return, the pace at which they do so, and whether they actually purchased the returned goods in the first place. Many sellers require a buyer to produce a sales return authorization number before its receiving department will accept a return. A return authorization number — or RA — allows sellers to track a return from its outset to its end.

What are the differences between gross sales vs. net sales?

If the difference between the numbers is very high, it can be a sign that your company is losing money on discounted products. “Net sales” and “gross profit” are similar–but not identical–concepts in business economics. Identifying the separate values allows business accountants to pinpoint what’s working and what isn’t with the structure and strategy of a business. As we said, gross sales shows your total revenue during a certain period, whether the last month, quarter, or year. If you are looking at Q1 of 2022, then you will gather all sales made during those three months (January through March).

Get a full visual of your business in an instant

Well, two of the most prominent ones are going to be gross sales and net sales. Very simply, gross sales are the total amount of your sales without factoring in deductions (costs incurred to close those sales). Net sales are your gross sales minus deductions such as allowances, discounts, and returns. These are both calculated at regular interviews throughout a fiscal year, typically monthly or quarterly. Net sales and gross sales are two metrics that your sales team or business use to measure your company’s revenue. If you find a product that’s common in returns, you can decide whether you need to improve it or remove it altogether.

How To Conduct Financial Analysis for Your Company

In this article, we’ll answer the question, “What is the formula for net sales and the formula for gross sales? ” and show you how to calculate your net and gross sales so you can create accurate sales forecasts. We’ll walk you through the formulas, outline their differences and show you how to identify issues or opportunities within the sales process. That refund would constitute a return, and that amount would be deducted from gross sales when calculating net sales. Even if you’re crushing your sales quotas, you need to have a deeper understanding of how your sales are trending to adapt strategies and keep an edge over the competition. Knowing the difference between gross and net sales — and how to track them — is key to this effort.

With this figure, business owners and accountants can gauge the efficiency of their manufacturing and sales efforts. In most states, a sales tax is charged in addition to the cost of any item you purchase. The total price you actually pay for a purchase is known as the gross price, while the before-tax price is known as the net sales price.

- The price the company pays is an allowance and that partial refund is reflected in the company’s net sales.

- For the same shoemaker, the net revenue for the $100 pair of shoes they sold, which allowed retailers to sell at a 40% discount to clear inventories, would be $60.

- Net revenue (or net sales) is defined by the US Securities and Commission Office (SEC) as gross revenue minus returns and allowances, such as sale promotions and purchase discounts.

- Net sales can help you identify problems in your sales strategies and production processes.

- They also had good times where they offered discounts to esteemed customers.

- Knowing your company’s net and gross sales improves your decision-making process by a mile.

- There are many gray areas in both recognition and reporting, but ultimately, all earned income from sales transactions falls into gross or net categories.

Allows for competitive marketing analysis

So, if a shoemaker sold a pair of shoes for $100, the gross revenue would be $100, even though the shoes cost $40 to make. As a rule of thumb, the lower the difference between gross sales and net sales is, the better the company’s products and customer satisfaction are. If the difference is significant, it’s an indication that there’s poor quality control within the company. The gap between your gross and net sales shows how well your sales team is performing. If the gap is too large, your team might be allowing way too many sales returns or bringing in valueless deals. Meanwhile, if it’s quite small, it could mean your sales team is performing well, and your profit margin is high.

A gross sales calculation example

Sales returns, allowances, and discounts are the three main costs that can affect net sales. All three costs generally must be expensed after a company books revenue. As such, each of these types of costs will need to be accounted for across a company’s financial reporting in order to ensure proper performance analysis. In total, these deductions are the difference between net sales and gross sales. If the company does not record sales allowances, sales returns, or sales discounts, there is no difference between net sales and gross sales. These deductions make the difference between net sales and gross sales.

A Guide to Managerial Accounting

- However, you could offer a sales discount where they can get around 2% off if they pay within the next 10 days (this particular offer would be known as a 1/20 net 10 in discount terms).

- The entity that provides and controls the goods or services is called the principal.

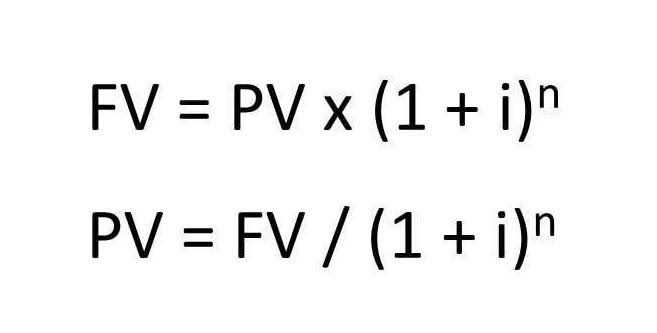

- If you know the sales tax rate and the gross price you paid, you can determine the net sales price by the following formula.

- However, this is generally more confusing, so net sales are typically the only value presented.

- See how Revenue Cloud goes from quote to cash on one platform, giving sales and finance one customer view.

- Gross profit is calculated using the net sales, and not the gross sales numbers.

- It reflects a business’s total revenue during a specific period but does not account for all the expenses accrued.

When the deductions are high then there is a reduction in Net sales and vice versa. These are the total unadjusted sales which means that they are the total sales before any discounts, allowances and returns. Gross pay and net pay are two important terms you can encounter gross sales vs net sales on your paychecks. Gross pay is the total you earn before taxes and deductions, while net pay is what actually hits your bank account. Gross means the total or whole amount of something, whereas net means what remains from the whole after certain deductions are made.

- In this article, we’ll answer the question, “What is the formula for net sales and the formula for gross sales?

- To help you through this dilemma, we’ll discuss gross sales thoroughly and tell you its definition, how to calculate it, and the difference between gross sales and net sales.

- In this case, the company might offer the retailer a 2% discount for paying off the invoice sooner.

- Knowing your gross sales helps you understand how product moves through your business, how much revenue your store is generating, and what your customers are purchasing.

- Another benefit of calculating gross sales is understanding the average consumer spending habits.

- As the net sales take into account the costs directly arising from the sales process, more business owners use this figure to guide their decision-making process.

It’s often used to indicate your business’s ability to sell its products and make income, but it doesn’t consider expenses. A seller will debit a sales discounts contra-account to revenue and credit assets. The journal entry then lowers the gross revenue on the income statement by the amount of the discount. Companies that allow sales returns must provide a refund to their customer. A sales return is usually accounted for either as an increase to a sales returns and allowances contra-account to sales revenue or as a direct decrease in sales revenue.